How you allocate the investments in your portfolio among the different asset classes will depend on several factors: your age, your family and financial situation, your tolerance for risk,  and investments you hold elsewhere, such as in an employer retirement account.

and investments you hold elsewhere, such as in an employer retirement account.

While no two situations are exactly alike, there are some basic allocation models to use as starting points—for example:

60% in the U.S. stock market and 40% in the U.S. bond market

40% in the stock market, 20% in international stock, and 40% in the total bond market

25% in large company stocks, 25% in small company stocks, 25% in international companies, and 25% in short-term Treasuries.

Whatever asset allocation you decide on initially, you should periodically review the portfolio to make sure the balance is consistent with your investment goals and life circumstances.

Reallocation

When you reallocate your portfolio, you adjust your asset allocation as your circumstances change. The allocation you picked as a single 25-year-old is likely too aggressive when you’re 50 and facing the prospect of sending a child to college. You may want to trim the amount you have in equities and other more risky investments, and beef up on safer fixed income and cash equivalents.

If you invest in a target date fund for your employer-sponsored retirement plan or other account, the fund automatically reallocates the holdings, shifting to more conservative investments as the target date approaches.

Rebalancing

Even when you are investing for the long term, you should periodically adjust your portfolio to account for swings in the financial markets. For example, if equities did extremely well, and fixed income did poorly, you may find that your portfolio has skewed from your preferred allocations.

One approach is to sell off the asset class that has performed well, locking in a profit, and buy securities in the asset class that has underperformed when those prices tend to be lower. Alternatively, you can designate your new investment money to the asset class that has done poorly until the balance is restored.

Sample Portfolios

There is no ideal or “right” portfolio allocation, since everyone’s situation is somewhat different. The following examples show different allocations for people of different ages with different lifestyle and financial circumstances.

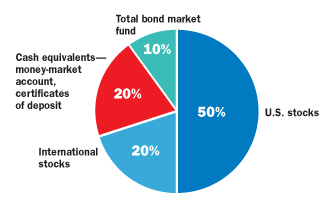

Hannah, Single 28

Hannah saves regularly when she can, and wants to invest money for a potentially higher rate of return.

Since she is relatively young, and has time to ride out market downturns, she chooses a relatively aggressive allocation, with 50% of her assets in domestic stock, 20% in international stock, and 10% in bonds.

To maintain an emergency cushion, Hannah decides to keep 20% of her assets in money markets and certificates of deposit.

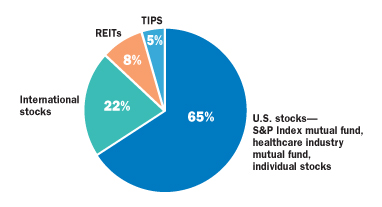

Rich and Elizabeth, Married, Late 30s

Since both Rich and Elizabeth believe they have steady jobs – and, combined, a healthy income – they have opted for a particularly aggressive asset allocation. That includes 65% in U.S. stocks, 22% in international stocks, and 8% in real estate investment trusts. A tiny percentage, 5%, is allocated to Treasuries.

The question is how they will fare in a market downturn, if they need cash and have to sell off stock when prices are low. They may also face some difficulty if one of them loses his or her job.

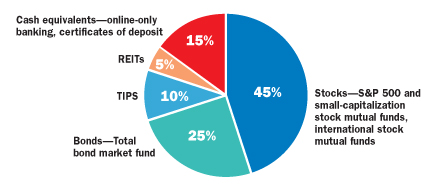

Don and Rosa, Married, Early 50s

Don and Rosa are helping foot the bill for two children in college, are worried about increasing healthcare expenses, and face another 10 years of mortgage payments on their house.

They need their portfolio to generate current income, while recognizing the importance of saving for their retirement. So they’ve allocated 25% of their portfolio to bonds, yet are keeping 5% in REITs and a healthy 45% percentage in equities, a which they anticipate could boost their returns to provide adequate retirement income.

They also have 15% in cash equivalents and 10% in TIPS to provide a hedge against inflation.

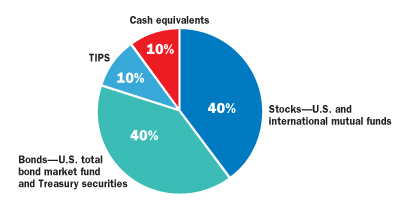

Juan, Single, 70

Juan is retired and is collecting a pension and Social Security. He prefers financial safety over potential gains and so he allocates 40% of his portfolio to bonds, 10% to tips, and 10% to cash equivalents.

Yet, Juan keeps 40% of his allocation in mutual funds in U.S. and international stocks to seek a higher return over time, which he may need if he lives many years in retirement, than he would receive from fixed income and cash equivalents.